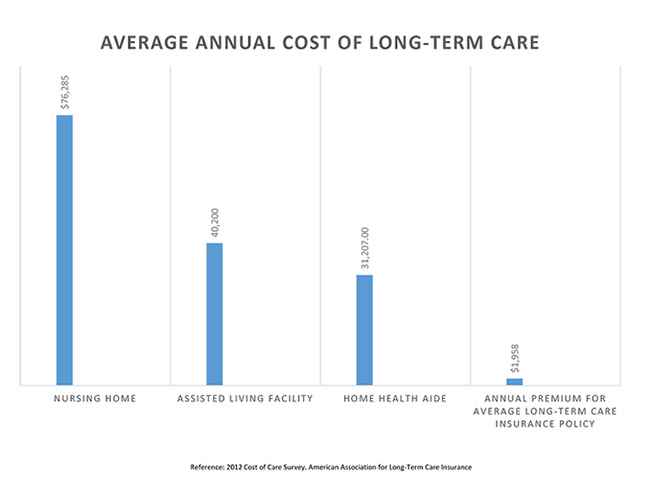

A financial plan that includes Long Term Care, or LTC insurance, is the best way to ensure that you and your family have adequate support, resources and choices for long-term healthcare. An illness, injury or even advanced age could otherwise end up depleting your savings, since the costs of care have risen drastically over the years.

Your unique needs and the desire to protect your assets are primary considerations for selecting the type and amount of LTC coverage. At LifeCentra we can help you understand and plan for any unforeseen event that may hamper your financial goals.

There are two basic coverage options available, one is long-term care and the other is asset care:

Long-Term Care

Long-term care refers to services designed to meet the needs of a person suffering from a disability or a chronic illness, when they are unable to care for themselves or earn an income to pay for their expenses over a long period of time.

Long-term care can be provided in a private home setting, a nursing home or an assisted living community. Commonly provided to senior citizens, there is no age limit for people who qualify for long-term care as long as they opt for these products as part of their insurance portfolio.

Long-term care is not necessarily restricted to medical care, but also includes assistance with everyday mobility needs, such as:

- Bathing

- Dressing

- Eating

- Transferring (for instance, from/to a bed or chair)

Other types of support may include completing everyday tasks, such as:

- Household chores

- Pet care

- Money management

- Shopping for groceries and other necessities

WE ARE HERE TO HELP

Call us at (747) 334-3799 to know more or schedule your one-on-one meeting with our expert.

Hybrid Care

Asset care is a combination of insurance and other financial vehicles that help to manage and preserve assets. It is often offered to individuals as part of long-term care services, allowing them to protect their accumulated wealth and property against loss caused by the inability to work or care for their self.

When you opt for a plan that includes asset care, you typically receive a guaranteed sum of life insurance benefits, which may be dispensed upon qualifying for long-term care expenses. There is a guaranteed interest rate on the premium, which increases the accumulated cash value every month and builds up a greater policy value over time, maintaining the integrity of your assets in the event where you need long term care.

WE ARE HERE TO HELP

Call us at (747) 334-3799 to know more or schedule your one-on-one meeting with our expert.

Still not sure what you need? Have question?

Still not sure what you need? Have question?