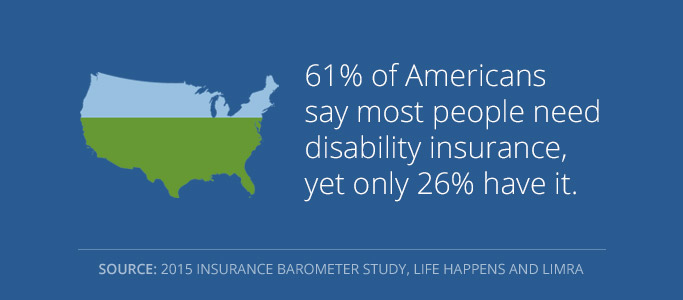

In the event you unable to work due to an unexpected illness, accident or injury in the workplace. Disability insurance products offer income replacement and financial stability.

LifeCentra will design a plan to meet your individual needs. To help you protect assets and reduce the risk of depleting savings and education/retirement funds during difficult times.

Disability Options available:

48% of all home foreclosures are the result of disability, while only 3% of all foreclosures result from death.

Individual

Individual disability insurance is a beneficial source of income for the self-employed, or for workers who want to supplement employer benefits. The insurance policy covers such professionals if an illness or injury leaves them unable to work. Benefits and premiums usually vary significantly between occupations, companies and states.

The advantage of individual disability insurance is the coverage continues as long as the premiums are paid on time. This is applicable even if a job change is made during the term of coverage provided by the plan. This kind of insurance policy is more portable and flexible than group disability insurance.

Business Overhead Expense

Business overhead expense disability insurance is a type of disability insurance designed for the needs of business owners. Under this kind of policy, if an owner becomes disabled and is unable to run their business, the company will be protected and overhead expenses will be covered.

Expenses covered include rent, salaries and payroll, utilities, interest on company debt, equipment and asset maintenance, accounting fees, subscriptions and memberships, rental, and depreciation of equipment. Without this insurance policy, entrepreneurs may run out of resources to operate their company in case of unexpected illnesses, accidents or injuries.

Key-Person

Key-person disability insurance is designed to provide disability protection to employees whose contributions are invaluable to a company’s operations. This coverage is particularly crucial for small businesses unable operate if key employees are disabled.

Should a key staff member pass away or unable to work due to a disability caused by illness/injury, the insurance policy provides coverage and benefits that allow the business owner to hire and train a replacement, settle debts, reassure lenders’ concerns over the financial capacity of the company. This type of coverage is invaluable for those who have their own business or play a large role in one.

Buy-Out

A buy-out plan is intended to provide the funding needed to purchase a disabled owner or partner’s interest in a business. Disability buy-out insurance should be part of any business continuation plan or business succession plan ensuring the disabled business owner receives a fair market value for their interest in the business. In addition a buy-out plan protects all business owners allowing them to buy-out the disabled owner’s interest at the price set forth in a buy-sell agreement.

LifeCentra has a disability expert to assist you with selecting the plan or plans to fit all your needs for today and tomorrow. Call us at 916-746-7888 to schedule your one-on-one meeting.

Disability Highlights

Still not sure what you need? Have question?

Still not sure what you need? Have question?