Latest Posts From LifeCentra Blog

We are happy to share our information and knowledge to assist in growing and securing your financial future. Please use the tabs below to guide you through the topics relevant to your interest.

Need immediate answers to your financial questions, email us at [email protected]

Top 7 Tips to Help You Save Money on Long Term Care Insurance

06 January 2016

Most people around the world are of the opinion that LTC, or Long-Term Care insurance, is quite expensive. This is right, to some extent. However, if you take care of certain things and plan your investment in time, you can save a lot of money on LTC insurance.

Read the full article >

The following are the top 7 methods that will help you cut down the cost of your long-term care insurance:

-

Look for State-Offered LTC Programs

If your state offers LTC insurance packages, you do not have to worry…

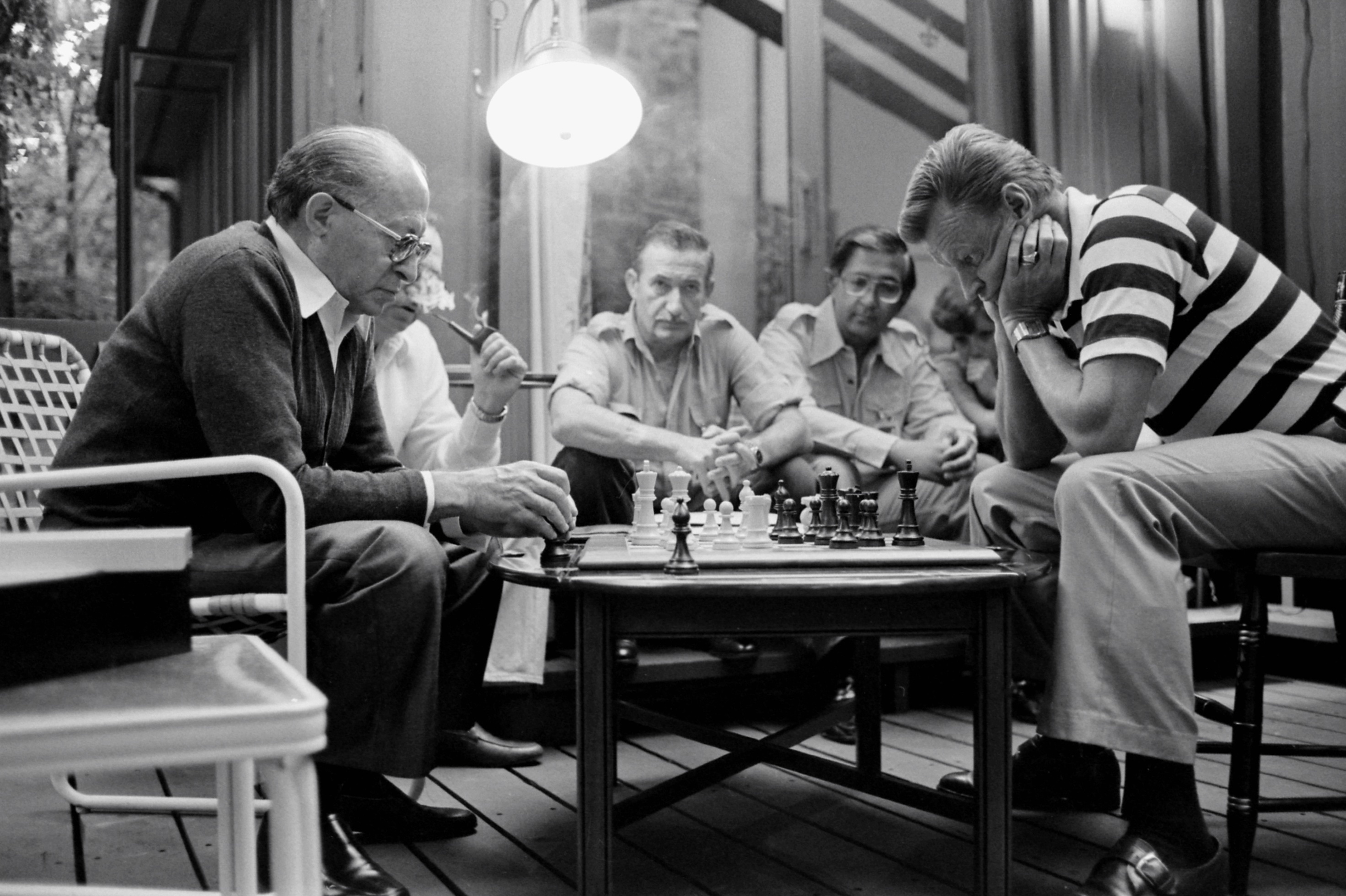

Chess and Finances – The Retirement Planning “Game”

28 December 2015

Have you ever played chess? Were you any good at it? Even if you were not good at the game, you must have noticed that it taught you a thing or two about learning to plan ahead, didn’t it?

Well, that’s what the game of chess is all about. It is about using mental energy to strategize moves well in advance as a means to corner the king and leave no room for him to run. It is about securing your position and being able to constantly form new strategies…

Read the full article >

Retirement Planning Tip: 6 Habits for Millennials and New Investors

26 December 2015

When it comes to saving for a financially secure future, millennials and new investors often ignore the importance of saving for their retirement. Typically, they are more focused on saving for the down payment for their dream home or being in a position to buy a new car, save for their children’s education, exotic travels and perhaps an emergency fund.

Yes, saving for retirement is pretty much the last thing on their minds. Millennials and new investors fail to understand that not making provisions for their retirement now could…

Read the full article >

Top 5 Financial and Retirement Planning Tips for Single Women

22 December 2015

While married couples receive extensive financial benefits when it comes to insurance, taxes, etc., single individuals often get the short end of the stick. Retirement planning becomes even more challenging, since you cannot rely on a spouse to help with saving for a retirement fund or enjoy the Social Security extras that married couples do.

For single women, taking care of family expenses and planning for retirement is even harder, what with lower pay scales and higher life expectancy, as well as reduced retirement benefits. They typically have to handle…

Read the full article >

SAVE

SAVE PRINT

PRINT SHARE

SHARE 0 Comments

0 Comments 10 years ago

10 years ago